How to Survive Your First Year in Business

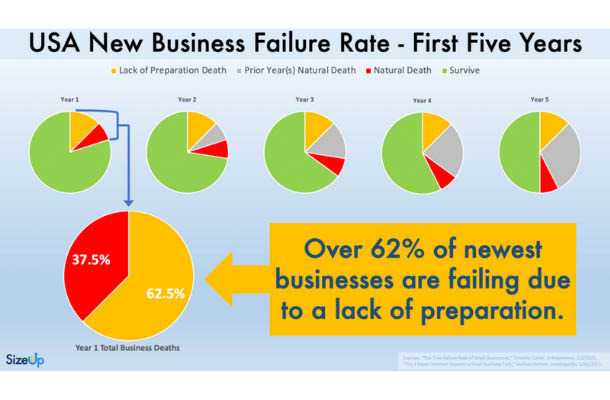

Did you know that 20% of small businesses fail to survive their first year? After that, the number falls even sharply, and only 50% of small businesses make it past the 5-year mark.

Marlene Joseph

Escucha este artículo

Did you know that 20% of small businesses fail to survive their first year? After that, the number falls even sharply, and only 50% of small businesses make it past the 5-year mark.

Most new entrepreneurs believe that they can make quick money in the first year. As a result, they fail to analyze the market and underestimate the hard work and consistency required to survive the first year and give their business a fighting chance for long-term success.

However, the hard truth is that not many businesses make money in the first year. In fact, the first year for any business is the most arduous.

Granted, the low chance of surviving may not sound that great, but it doesn’t mean that you should get disappointed and let 50-50 chance dictate your fate.

So how can you survive the first year without giving up or burning out?

This is precisely what we will be discussing in this article, so read on.

Create a Strong Business Plan

It is crucial to pen down a solid business plan to hone your vision before stepping into the business world. While you don’t need to create a 100-page lengthy document, it will be sufficient to create a detailed plan that determines the strength of your target market and business model.

If you have completed your master of business administration online from a reputed institute, it wouldn’t be hard for you to devise a business plan. However, if you plan to start a business without looking for a bank loan or an investor, you can avoid devising a business plan altogether.

At the bare minimum, a good business plan answers crucial questions about a business, such as what problem are you willing to solve, what is the realistic timeframe for sales, launch and profitability, whose lives are you trying to improve, your business model, business objectives, value proposition, financial and marketing plan, post and future milestones, etc.

Read also: Could the New Variant Of The Coronavirus Affect The Latin American Economy?

Don’t Be Too Excited About Profits

As soon as the money starts coming into your business, you will likely get excited. However, most startups fail to realize that you have to pay quarterly taxes to the federal government and your state on any gains or profits made. Thus, unless you pay off your taxes on time, you need to ensure proper budget allocation for the cause.

Also, depending upon your business model, you may need to pay income taxes and payroll taxes. In addition, several localities also charge business license fees according to the money you make. In other words, if you have a profitable year, you would need to pay even more for the business license next year.

Consider Accounting from Day One

Getting your financials in order and planning early on can save you from financial challenges down the line. So, suppose you haven’t gotten your accounting in order yet. In that case, we recommend you register your business and set up a business bank account, get an accountant and use reliable cloud accounting software.

This will help you keep your cash categorized and organized from the start. Also, don’t neglect the tax preparation and filing. In other words, keep a pulse on your day-to-day financial activity.

This step is crucial because the first year of every business is hectic, and people usually don’t get time to balance the books effectively, focus on filing taxes on time and correctly, manage invoices and other financial responsibilities that you may have as an entrepreneur.

However, if you don’t have enough budget to hire the required resources, a seamless accounting software integration would do a lot of the work for you.

Stop Mistaking Hyperactivity with Productivity

In today’s business culture, everybody is busy all the time. Yet, how much of our busy schedule is helping in moving the business or company forward? Well, during the first year of business, you should be pretty selective about how you are spending your resources and time. It is a common observation that many entrepreneurs try to burn the candles at both ends but even with so much effort, the business only moves sideways and not forward.

This means that you should be careful before saying yes to each request that comes your way. The best approach before considering each event, customer request, partnership opportunity, or marketing is to think about how well it fits your overall game plan and priorities.

Build Strong Network

It is said, the more people you know, the better it is. While you may think that anyone can be a potential customer, partner, sounding board, or source of inspiration, it is better to be selective. Therefore, reach out only to professionals in your industry or field or people who have started similar or their businesses.

While it is essential to reach out to more people, it is also necessary to reach out to relevant people. The more relevant people you reach out to, the more and better opportunities will come your way. Also, the more supporters you will find around you when you need them.

So, respect people’s time yet be fearless in reaching out for important meetings. Whenever you meet someone, try to ask as many questions as possible. This will provide others with the opportunity to discuss and talk about themselves. Similarly, always try to pick up the tab and don’t hesitate to send a follow-up thank you. Needless to say, never ignore the golden rule in networking, i.e., the more you give, the more it will encourage others to give back.

Final Thoughts

All of the considerations mentioned above are some of the many ways you can kickstart a successful business and continue to enjoy it for years without worrying about its survival or facing challenges. Launching any business involves risk. It is indeed a stress-inducing endeavor. Therefore, to succeed in the first year, don’t be afraid to take the plunge. In fact, go ahead, plan, measure, be conservative in your spending, adapt and then adapt some more.