LatinAmerican Post brings some data on the current situation that the North American superpower is experiencing due to its public debt and the consequences it would suffer if it defaulted on its economic responsibilities. This is what the US debt looks like in numbers.

Photo: Freepik

LatinAmerican Post | Christopher Ramírez Hernández

Escucha este artículo

Leer en español: Infografía: deuda en Estados Unidos, datos que podrían llevar a un default

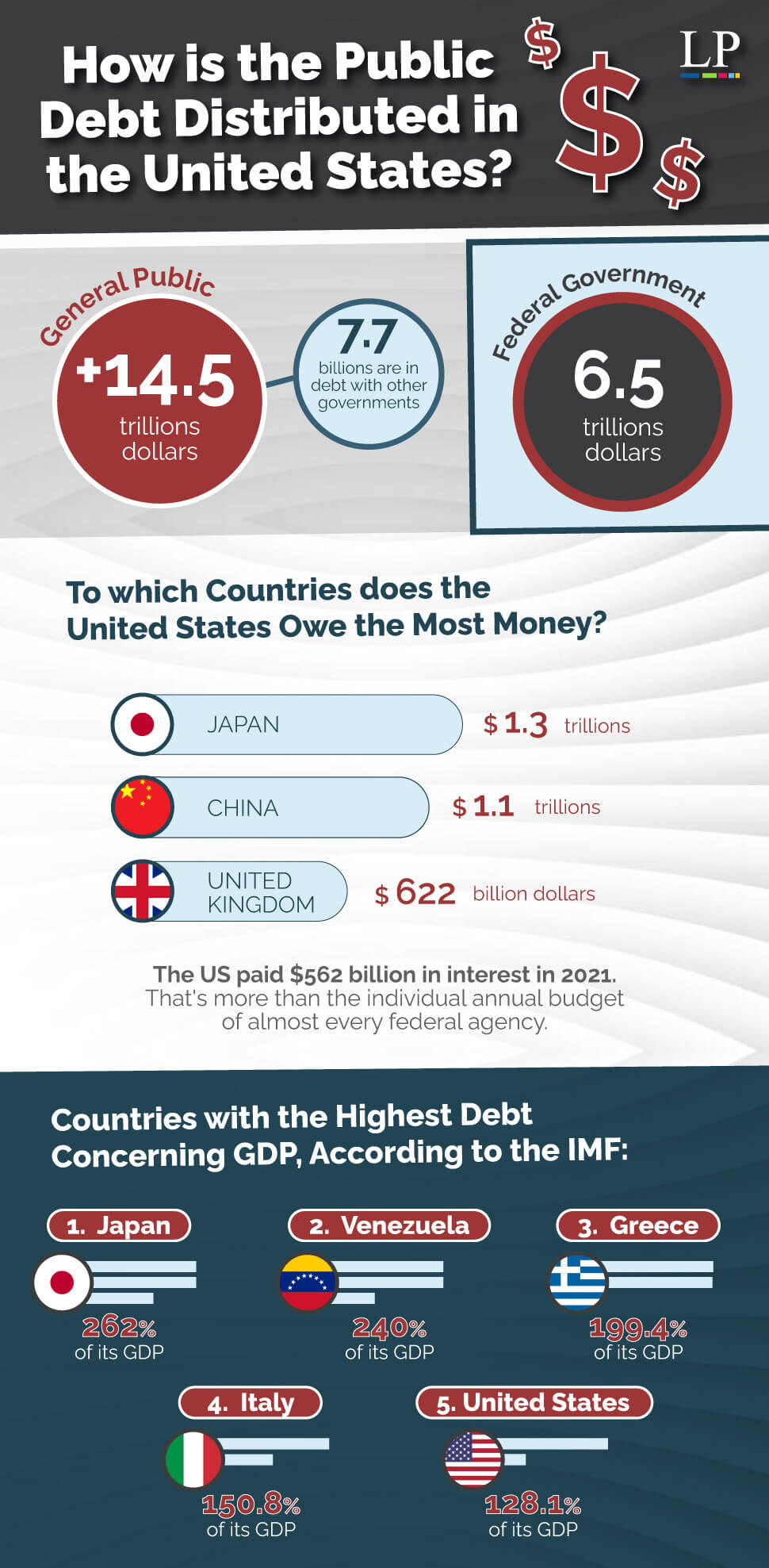

The US debt ceiling reached a new record of $31.4 trillion earlier this year. Before the pandemic, the national debt was 22.7 trillion dollars, but in just one year, it increased by 5 trillion dollars, reaching 27.7 trillion dollars in 2020. Since then, more than $2 trillion in additional debt has accumulated, reflecting the significant impact of cash injections on the US economy.

You can also read: FED: What Does the Rise in Interest Rates Represent for the Latam Economy?

This steady growth in federal debt raises concerns about the long-term financial sustainability of the country. While the government's response to the pandemic was necessary to mitigate the economic impacts, the rising debt poses challenges in terms of future funding, repayment capacity, and the burden on future generations.

What would Happen if the Public Debt was Not Paid?

A default on the U.S. public debt (also called a technical default) would have severe domestic and international consequences. The government would be unable to pay for social programs and the military, harming society.

At the international level, the country could be excluded from financial markets, face high-interest rates in case of obtaining loans, and suffer embargoes and expropriations of assets abroad. In addition, default could generate high inflation or hyperinflation, affecting its internal economy.